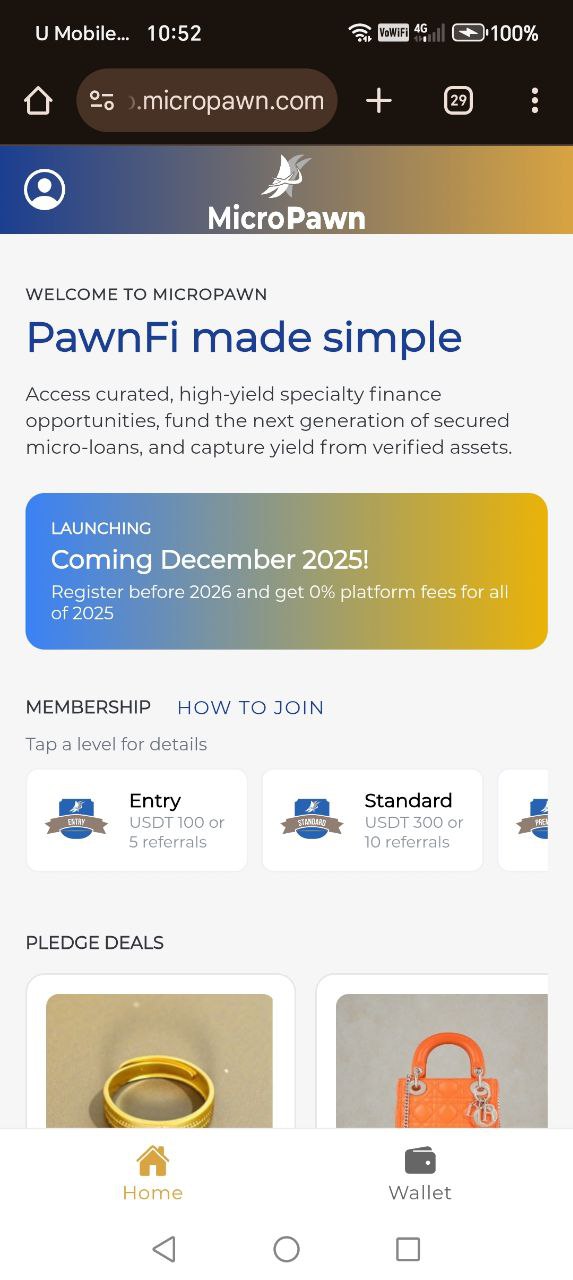

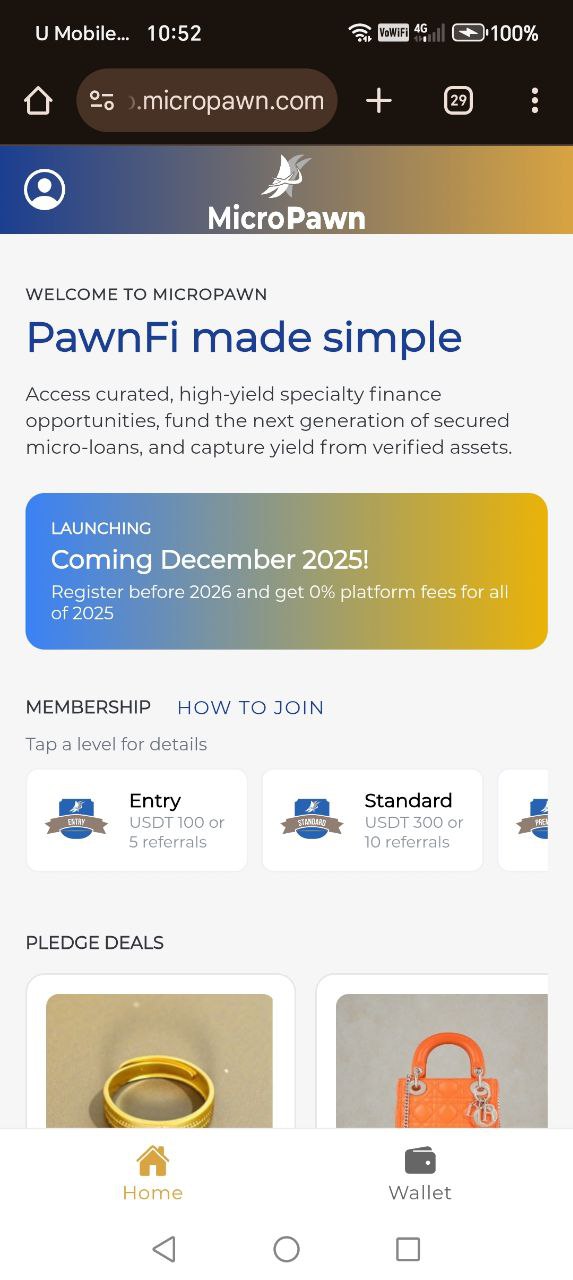

MicroPawn is a fintech platform that connects pawnshops with investors through a transparent, valuation-driven system. Instead of operating as a pawnshop, MicroPawn acts as a neutral bridge that verifies assets, standardizes collateral valuation, and provides access to investor liquidity. The platform modernizes secured lending by eliminating overvaluation risk and creating a safer, smarter, and more scalable ecosystem for both pawnshops and investors.

Features

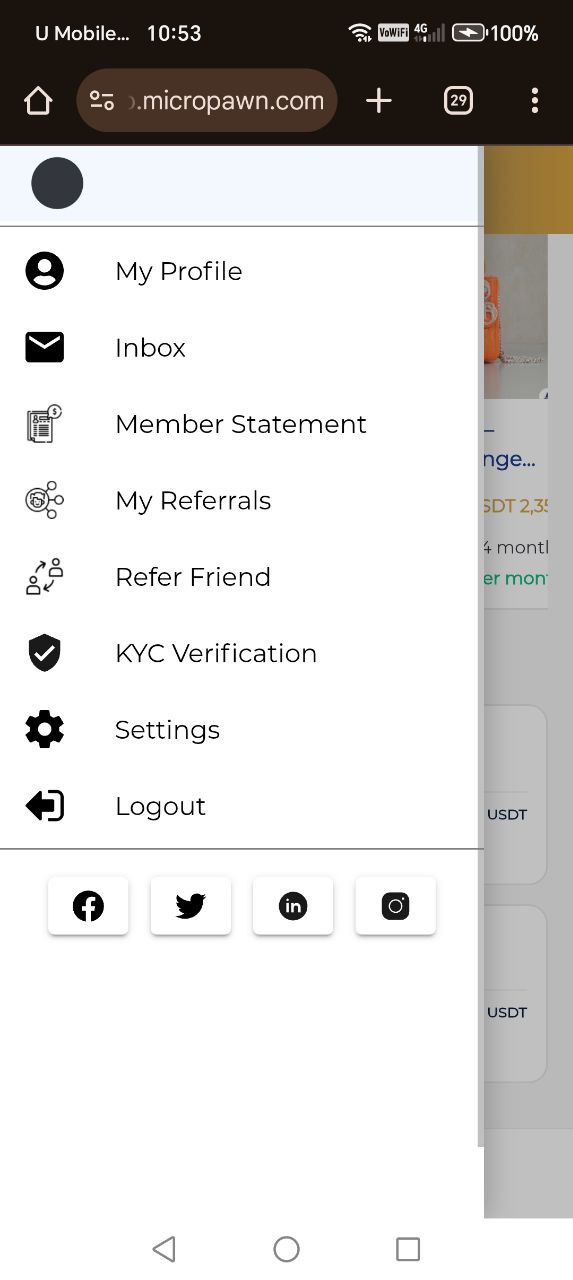

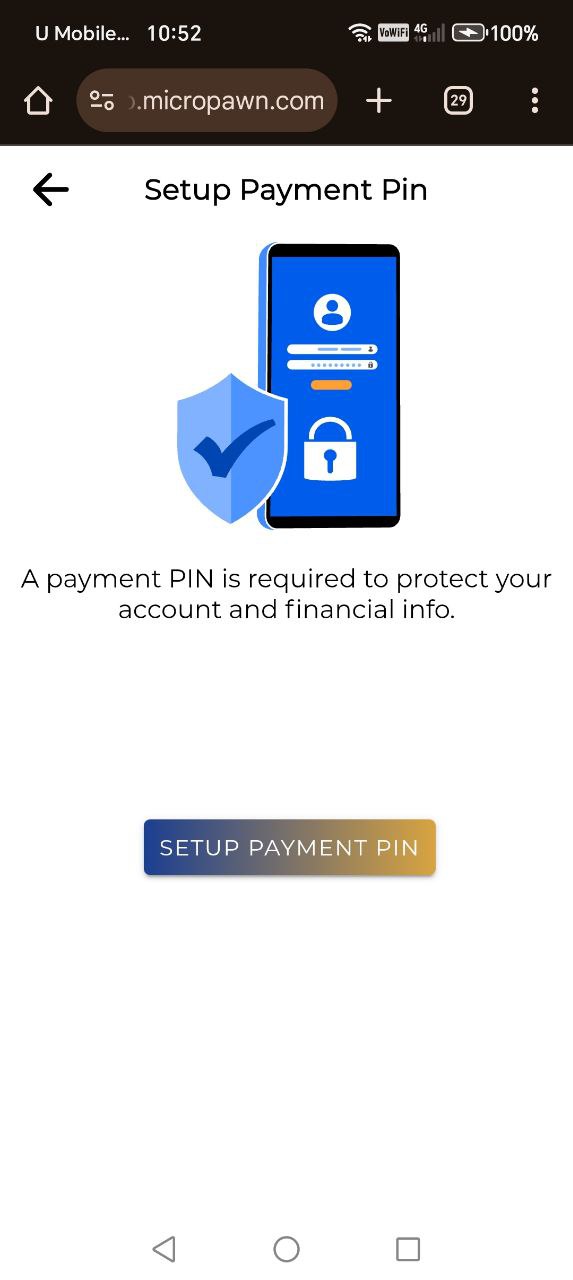

MicroPawn combines transparent valuation, verified asset workflows, and investor participation in a single ecosystem. Every user and investor undergoes KYC verification to ensure trust and compliance, while membership tiers provide access to exclusive features and investment opportunities. Assets are managed through a secure blockchain wallet, ensuring traceability and transparency in every transaction. By operating as a risk-controlled middle layer, MicroPawn enhances trust, reduces fraud, and digitizes the entire pawn financing workflow for both pawnshops and investors.

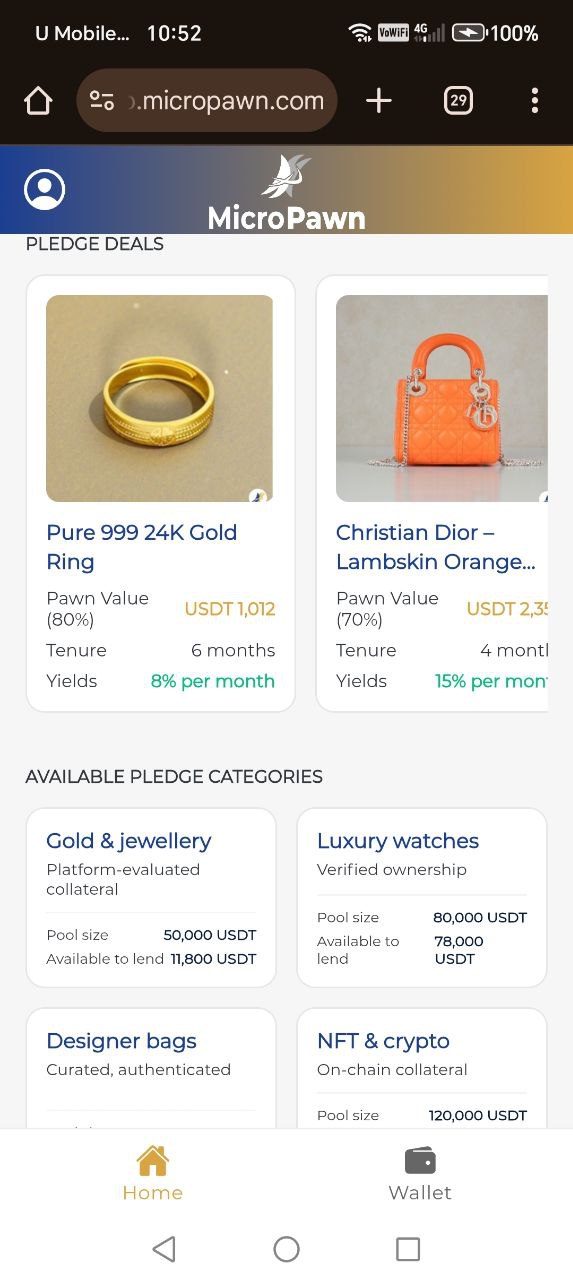

Use Cases

MicroPawn can be used by pawnshops that want to expand their lending capacity without relying solely on their own cash reserves. Investors can participate in asset-backed opportunities with the confidence that every deal is verified, assessed, and transparently valued. The platform also benefits valuation experts who can offer professional assessment services within the ecosystem. Overall, MicroPawn enables traditional pawn operations to modernize, helps investors access stable collateral-based returns, and allows the secured lending market to scale in ways that were not possible before.

Comments

Thanks for checking out MicroPawn! 🎉 We built this platform to bring transparency, fair valuation, and investor liquidity to the pawn industry. Unlike traditional pawnshops, MicroPawn connects pawnshops and investors through a verified, blockchain-secured system. We’d love to hear your thoughts: How do you see technology transforming traditional lending? Feedback, questions, or ideas are always welcome! 🚀

The part I’m most curious about is how you keep valuation honest over time (market moves, condition disputes, and incentives): are appraisers independent/rotated, and do you publish haircut/advance-rate rules by asset class so investors can understand downside protection? Also, if everything is KYC’d and “verified,” what’s the process when an asset is later found to be misrepresented—does the platform provide any buyback/insurance mechanism, or is that risk explicitly borne by the investor/pawnshop?

Premium Products

Sponsors

BuyAwards

View allAwards

View allMakers

Makers

Comments

Thanks for checking out MicroPawn! 🎉 We built this platform to bring transparency, fair valuation, and investor liquidity to the pawn industry. Unlike traditional pawnshops, MicroPawn connects pawnshops and investors through a verified, blockchain-secured system. We’d love to hear your thoughts: How do you see technology transforming traditional lending? Feedback, questions, or ideas are always welcome! 🚀

The part I’m most curious about is how you keep valuation honest over time (market moves, condition disputes, and incentives): are appraisers independent/rotated, and do you publish haircut/advance-rate rules by asset class so investors can understand downside protection? Also, if everything is KYC’d and “verified,” what’s the process when an asset is later found to be misrepresented—does the platform provide any buyback/insurance mechanism, or is that risk explicitly borne by the investor/pawnshop?

Premium Products

New to Fazier?

Find your next favorite product or submit your own. Made by @FalakDigital.

Copyright ©2025. All Rights Reserved