Expense Hub

AI Powered Expense Management Tool for SMBs

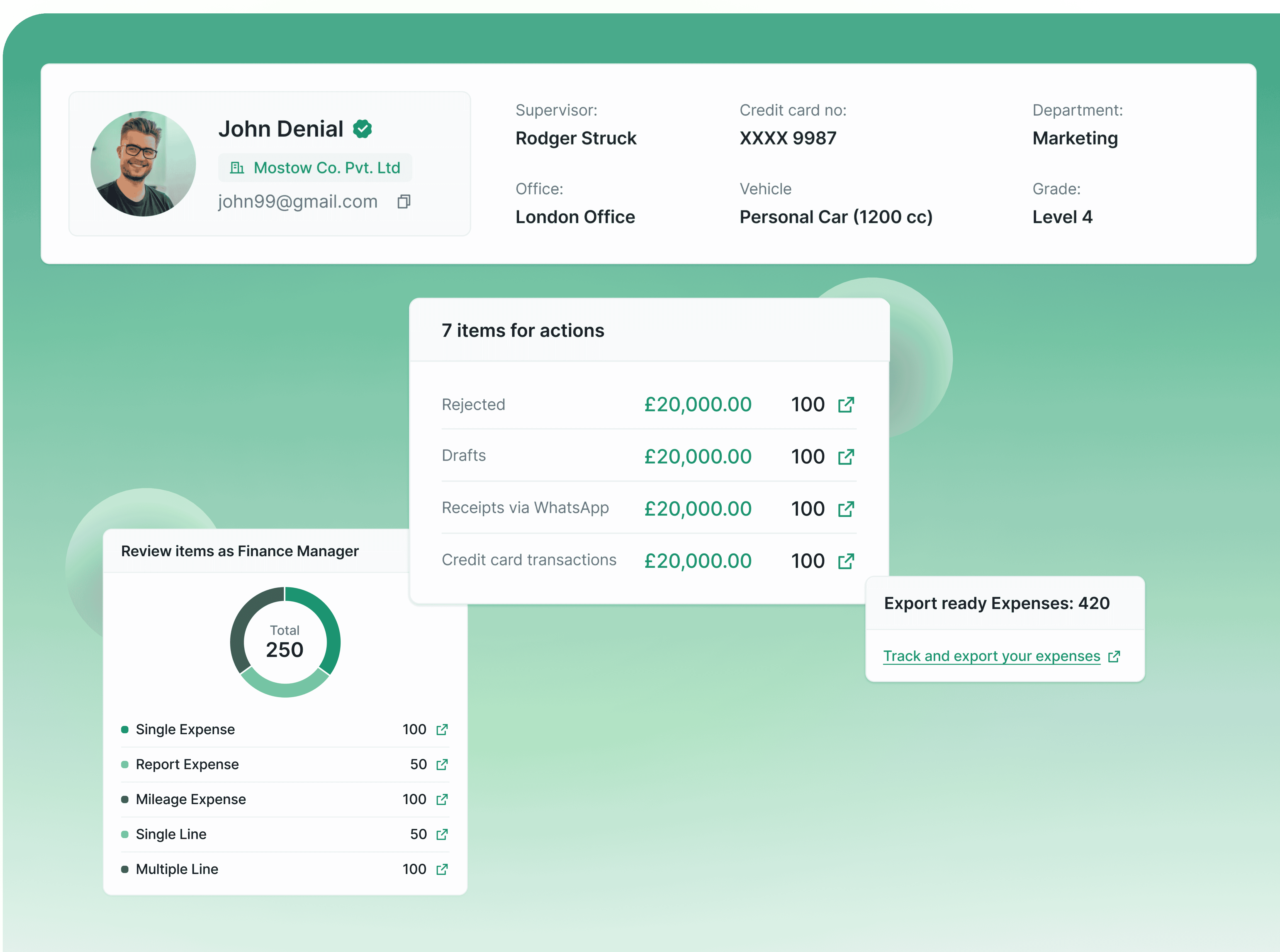

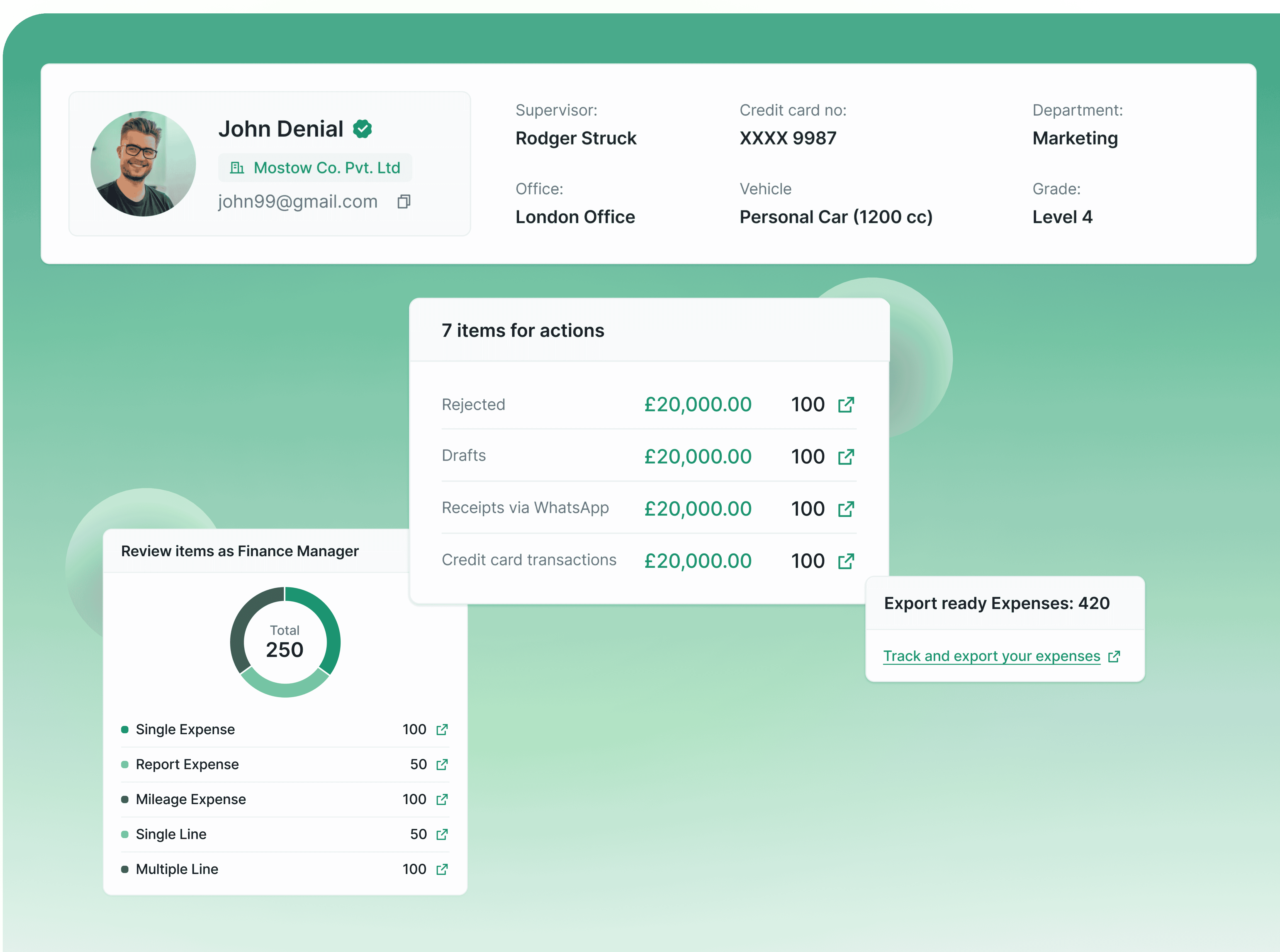

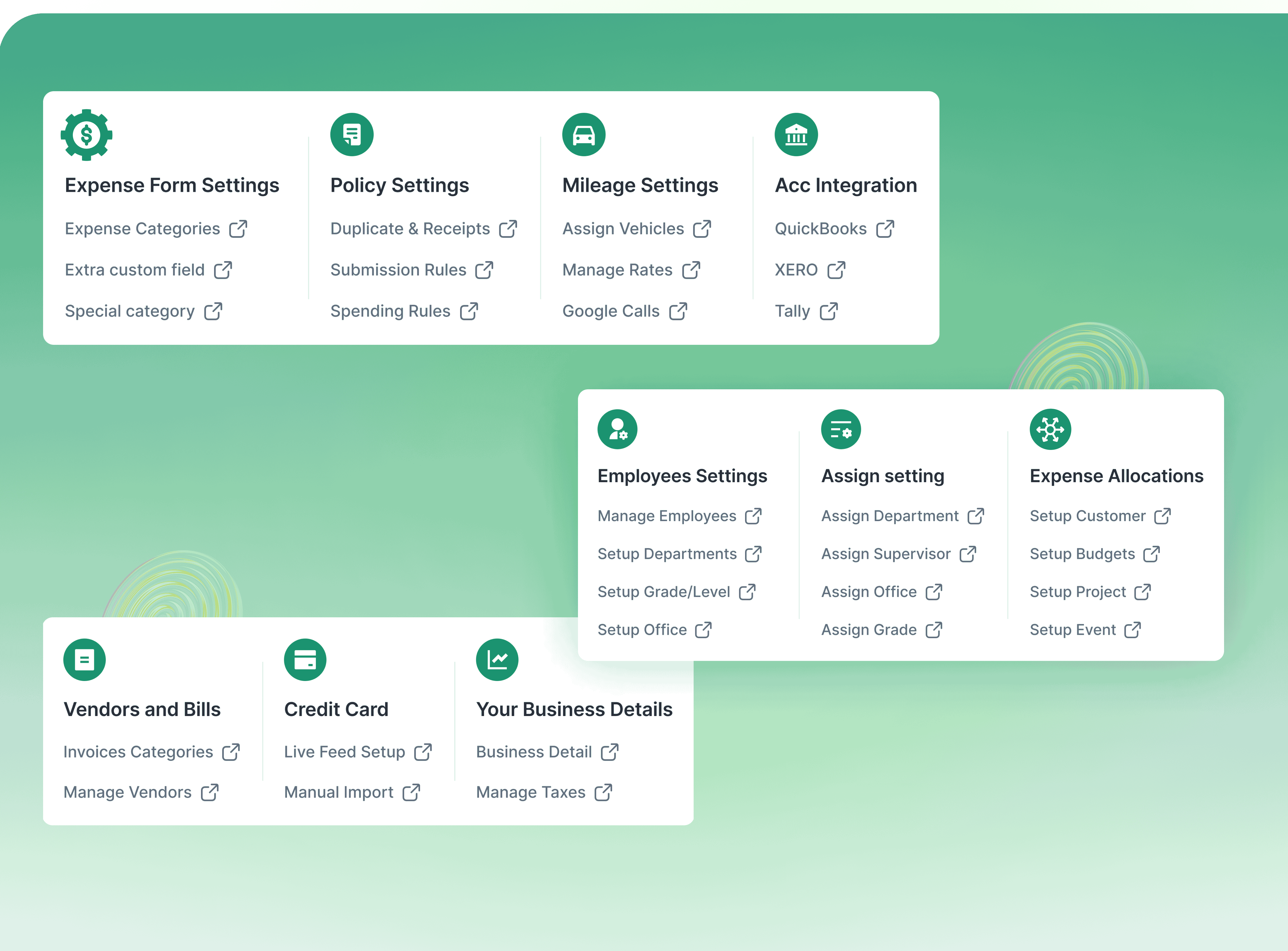

Expense Hub is an advanced expense management and spend management platform purpose-built for small and mid-sized businesses aiming to streamline financial operations. Our software automates employee expenses with an AI Receipt Assistant, allowing instant receipt uploads via WhatsApp and seamless categorization.

Powered by smart automation, Expense Hub handles credit card spend tracking, real-time expense reports, and simplifies expense policy enforcement to ensure compliance and reduce fraud. Featuring HMRC-compliant mileage expense tracking powered by Google Maps, the platform accurately calculates distances, supports precise TAX reclaim, and offers detailed reporting capabilities.

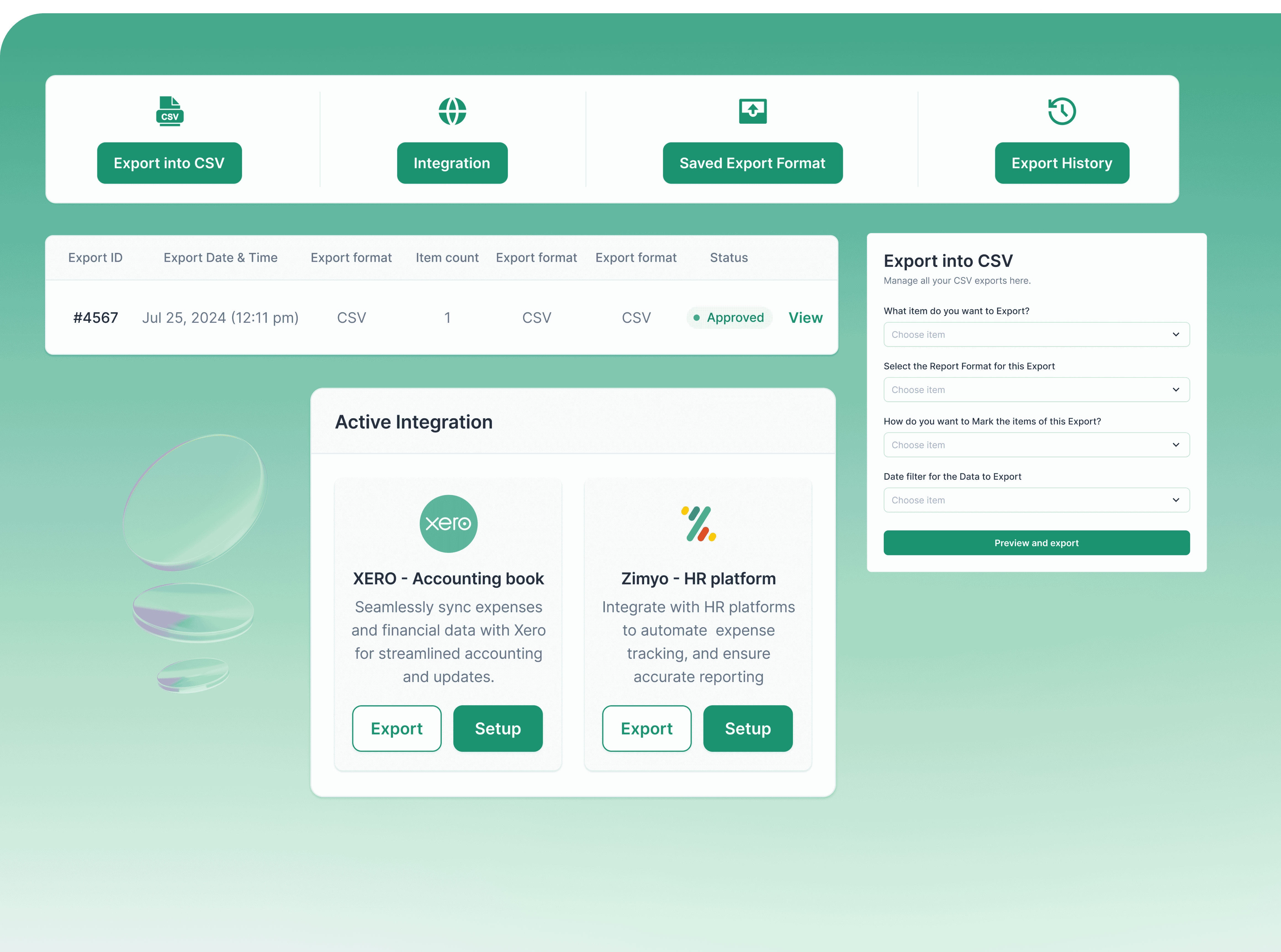

With integrated tools for project and budget control, teams gain clarity into their financial activities, enabling proactive spend analysis. Expense Hub seamlessly integrates with leading accounting software, including Xero Integration and QB Integration, to ensure smooth data transfer and efficient bookkeeping.

Expense Hub transforms expense chaos into organized, actionable financial insights—making expense management effortless, compliant, and audit-ready.

Features

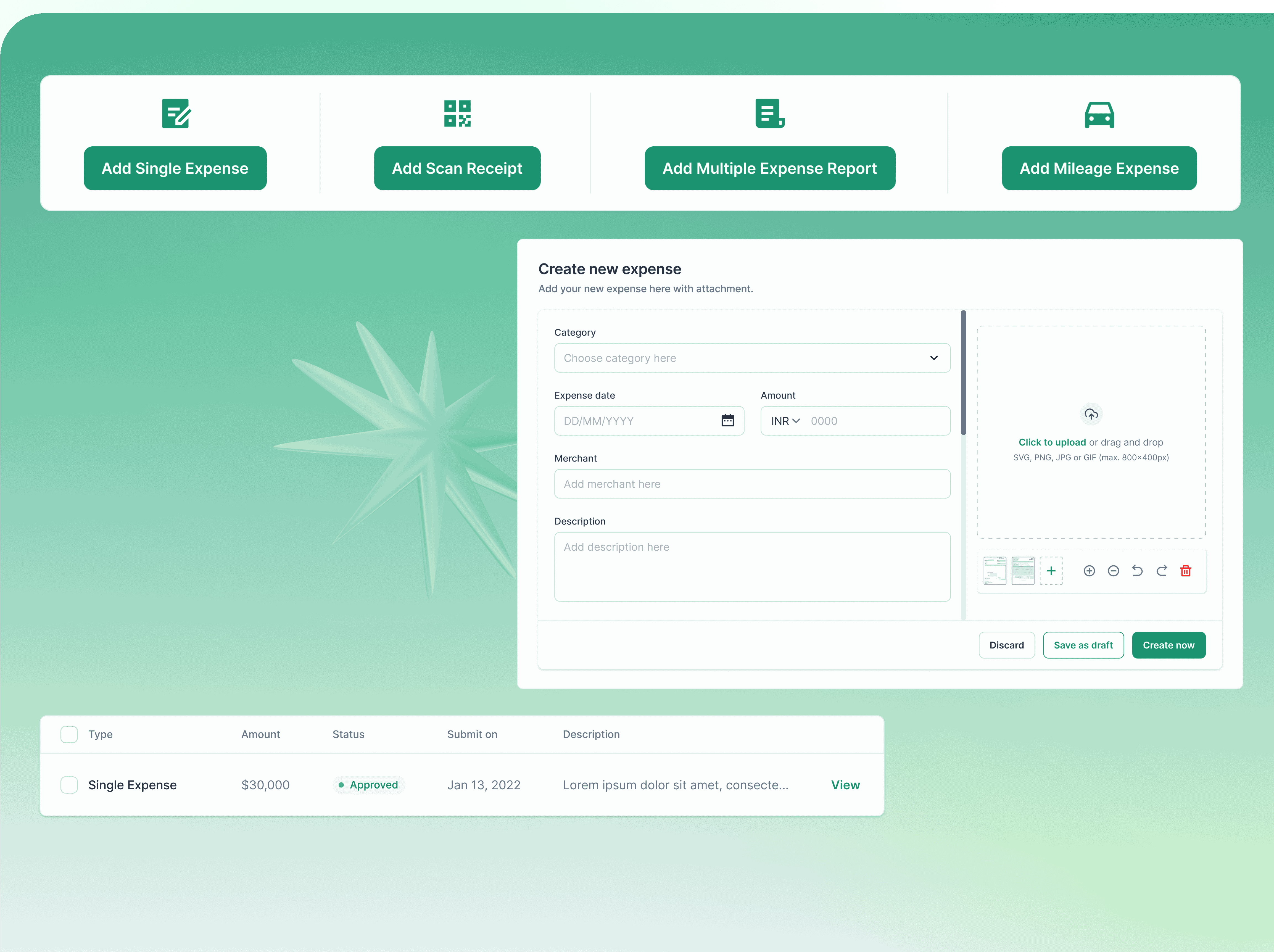

Expense Tracking & Automation

- AI-powered Receipt Assistant

- WhatsApp Receipt Upload

- Automatic Credit Card Expense Matching

Mileage Tracking

- UK HMRC-Compliant Mileage Logging

- Google-Powered Route Validation

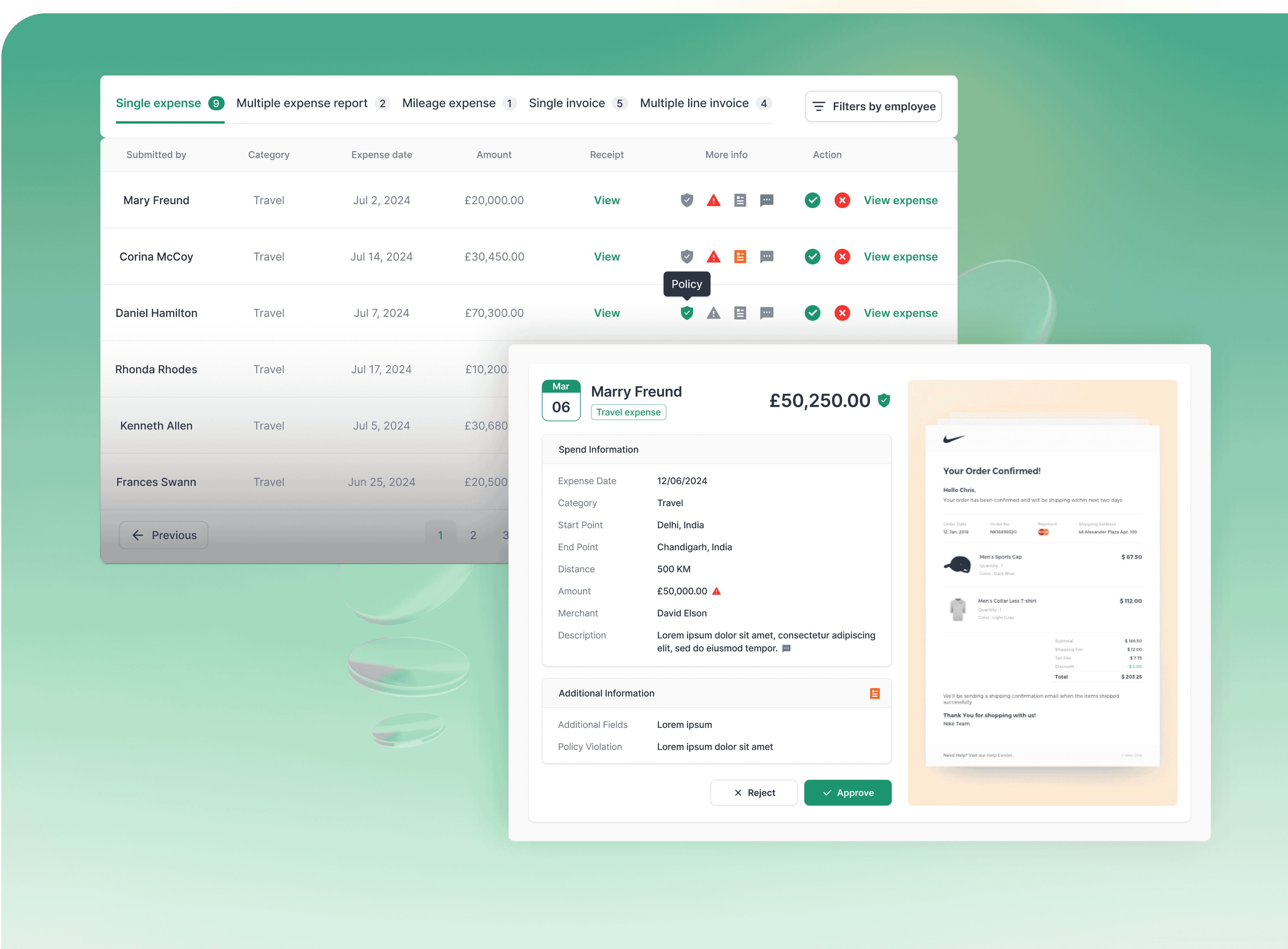

Compliance & Policies

- Real-time Expense Policy Enforcement

- Customizable Approval Workflows

Budget & Project Management

- Project & Event Budget Tracking

- Real-time Budget Alerts & Insights

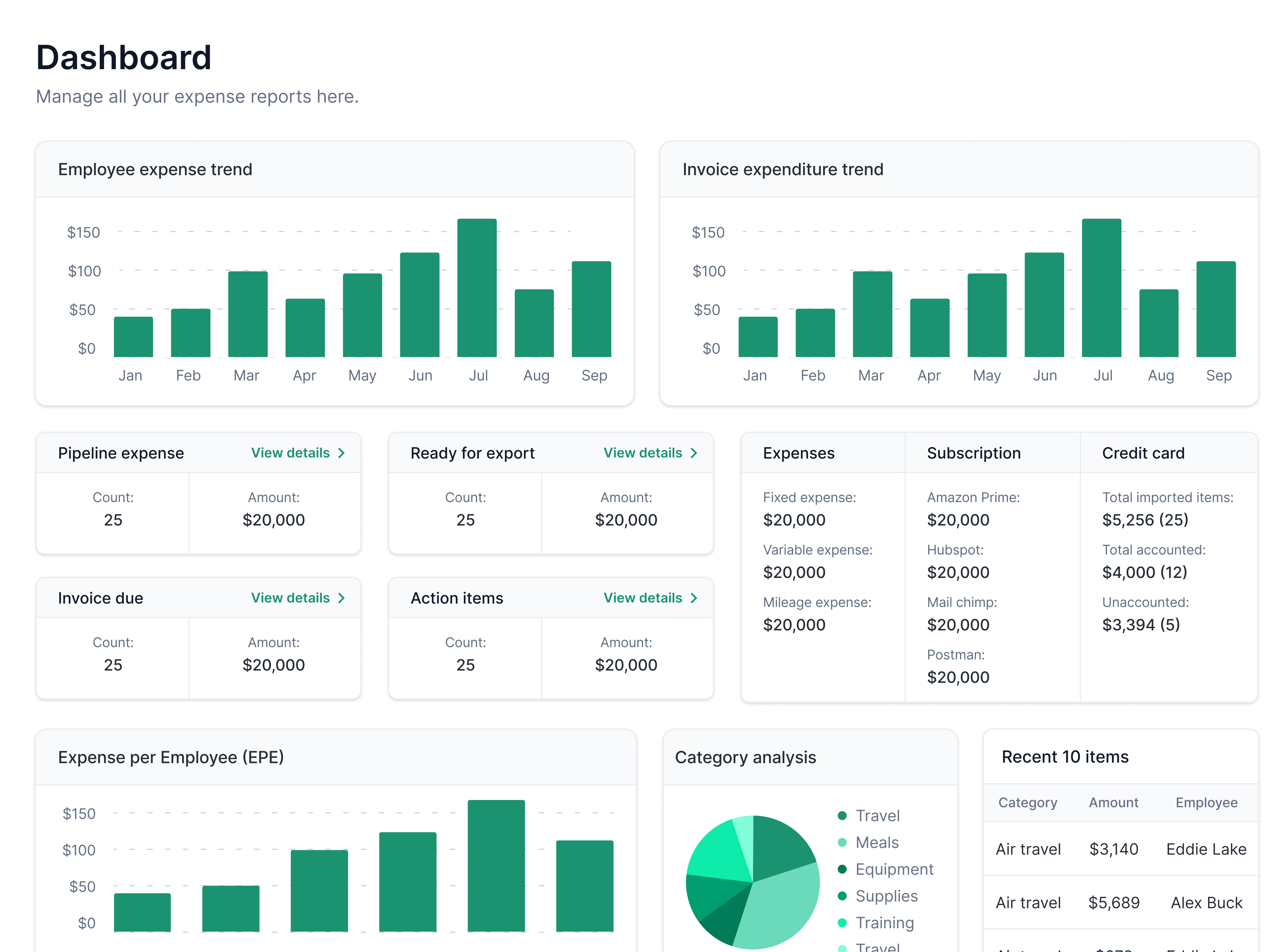

Reporting & Analytics

- Detailed Expense Reports

- Real-Time Dashboards and Visual Analytics

- Exportable Reports (CSV, PDF)

Integrations & Compatibility

- Xero Accounting Integration

- QuickBooks Integration

- Multi-Currency Support

Tax & Audit

- Automated VAT/GST Tax Reclaim

- Audit-Ready Expense Documentation

User Experience

- Mobile App Access

- User-Friendly, Intuitive Interface

- Multi-level User Permissions

Use Cases

1. Employee Reimbursement Automation

Employees submit expenses via WhatsApp or web, and the AI assistant auto-categorizes, matches receipts, and routes for approval—no more manual tracking or lost receipts.

2. Credit Card Spend Reconciliation

Automatically match corporate card transactions with submitted receipts. Get notified of missing receipts or policy breaches in real time to simplify monthly reconciliation.

3. HMRC-Compliant Mileage Tracking

Field staff or sales teams can log trips accurately using Google-powered mileage tracking. Expense Hub applies the correct HMRC rates and detects detours or inconsistencies.

4. Project & Event Budget Control

Finance teams can assign and track budgets per client project or company event. Monitor actual vs. allocated spend in real time to stay on budget and avoid overspending.

5. Expense Policy Enforcement

Set spending limits by employee grade, category, or location. Automatically detect policy violations before approval to ensure compliance and reduce financial risk.

6. Tax Reclaim & Audit Prep

Easily identify reclaimable VAT/GST and export audit-ready reports with categorized expenses, supporting documents, and approval trails—saving hours during tax season.

7. Multi-Level Expense Approval

Create custom approval flows based on departments, expense types, or spend limits. Notifications and AI-assist help speed up decision-making without bottlenecks.

8. Real-Time Financial Visibility

Finance managers can access live dashboards, expense reports, and category breakdowns to analyze trends, control budgets, and forecast future spend more accurately.

Comments

ExpenseHub.io — Built from Frustration, Fueled by Chaos Every month ended the same way: receipts lost in inboxes, spreadsheets stitched together with hope, and finance folks one late reimbursement away from burning it all down. I was using one of the “market leaders” — $10 per user, per month — for what? A dashboard that moved like molasses and an approval flow that felt like a Kafka novel. The tools were built for Fortune 500s with finance departments the size of football teams. Not for teams like mine. Not for businesses where time actually matters. So I built ExpenseHub.io. Not in a VC tower. In quiet moments between broken tools and the blinding fury of yet another “missing receipt” Slack thread. What Is ExpenseHub.io? ExpenseHub is for the people who live in the mess — employees snapping receipts at gas stations, finance heads chasing mileage logs, founders trying to track burn rate in Google Sheets. It’s an AI-powered expense management platform that works like your sharpest finance analyst, but never sleeps. How It Fights the Problems: WhatsApp Receipts — Just snap and send. Our AI does the rest. Credit Card Matching — Transactions get matched with receipts like a heat-seeking missile. Mileage Tracking — HMRC-compliant and smart enough to catch detours. Real-Time Policy Enforcement — Catch violations before they hit your books. Projects, Events, and Budgets — Know what you’re spending, where, and why. Xero Integration — Because clean books are beautiful. The Stack Founded by Abhiranjan Shukla and Ashish Kumar with a team of 4 devs, a few freelancers, and way too much coffee. React. Node. Python. Postgres. OCR. A bit of magic. Hosted on Digital Ocean, protected by Cloudflare, powered by the fury of every lost reimbursement we’ve ever had to chase. Why We Did It: Not for funding. Not for headlines. We built Expense Hub because managing money shouldn’t be harder than making it. If you’ve ever cursed at a PDF receipt, screamed into a spreadsheet, or spent hours doing what a smart machine could do in seconds, come check us out. 👉 https://expensehub.io 30-day free trial. No credit card. No catch. Just peace of mind in a messy world.

I was using one of the “market leaders” — $10 per user, per month — for what? A dashboard that moved like molasses and an approval flow that felt like a Kafka novel. The tools were built for Fortune 500s with finance departments the size of football teams. Not for teams like mine. Not for businesses where time actually matters.

Premium Products

Sponsors

BuyMakers

Makers

Comments

ExpenseHub.io — Built from Frustration, Fueled by Chaos Every month ended the same way: receipts lost in inboxes, spreadsheets stitched together with hope, and finance folks one late reimbursement away from burning it all down. I was using one of the “market leaders” — $10 per user, per month — for what? A dashboard that moved like molasses and an approval flow that felt like a Kafka novel. The tools were built for Fortune 500s with finance departments the size of football teams. Not for teams like mine. Not for businesses where time actually matters. So I built ExpenseHub.io. Not in a VC tower. In quiet moments between broken tools and the blinding fury of yet another “missing receipt” Slack thread. What Is ExpenseHub.io? ExpenseHub is for the people who live in the mess — employees snapping receipts at gas stations, finance heads chasing mileage logs, founders trying to track burn rate in Google Sheets. It’s an AI-powered expense management platform that works like your sharpest finance analyst, but never sleeps. How It Fights the Problems: WhatsApp Receipts — Just snap and send. Our AI does the rest. Credit Card Matching — Transactions get matched with receipts like a heat-seeking missile. Mileage Tracking — HMRC-compliant and smart enough to catch detours. Real-Time Policy Enforcement — Catch violations before they hit your books. Projects, Events, and Budgets — Know what you’re spending, where, and why. Xero Integration — Because clean books are beautiful. The Stack Founded by Abhiranjan Shukla and Ashish Kumar with a team of 4 devs, a few freelancers, and way too much coffee. React. Node. Python. Postgres. OCR. A bit of magic. Hosted on Digital Ocean, protected by Cloudflare, powered by the fury of every lost reimbursement we’ve ever had to chase. Why We Did It: Not for funding. Not for headlines. We built Expense Hub because managing money shouldn’t be harder than making it. If you’ve ever cursed at a PDF receipt, screamed into a spreadsheet, or spent hours doing what a smart machine could do in seconds, come check us out. 👉 https://expensehub.io 30-day free trial. No credit card. No catch. Just peace of mind in a messy world.

I was using one of the “market leaders” — $10 per user, per month — for what? A dashboard that moved like molasses and an approval flow that felt like a Kafka novel. The tools were built for Fortune 500s with finance departments the size of football teams. Not for teams like mine. Not for businesses where time actually matters.

Premium Products

New to Fazier?

Find your next favorite product or submit your own. Made by @FalakDigital.

Copyright ©2025. All Rights Reserved