BankGPT

AI Assistant for Statements, Invoices & Receipts

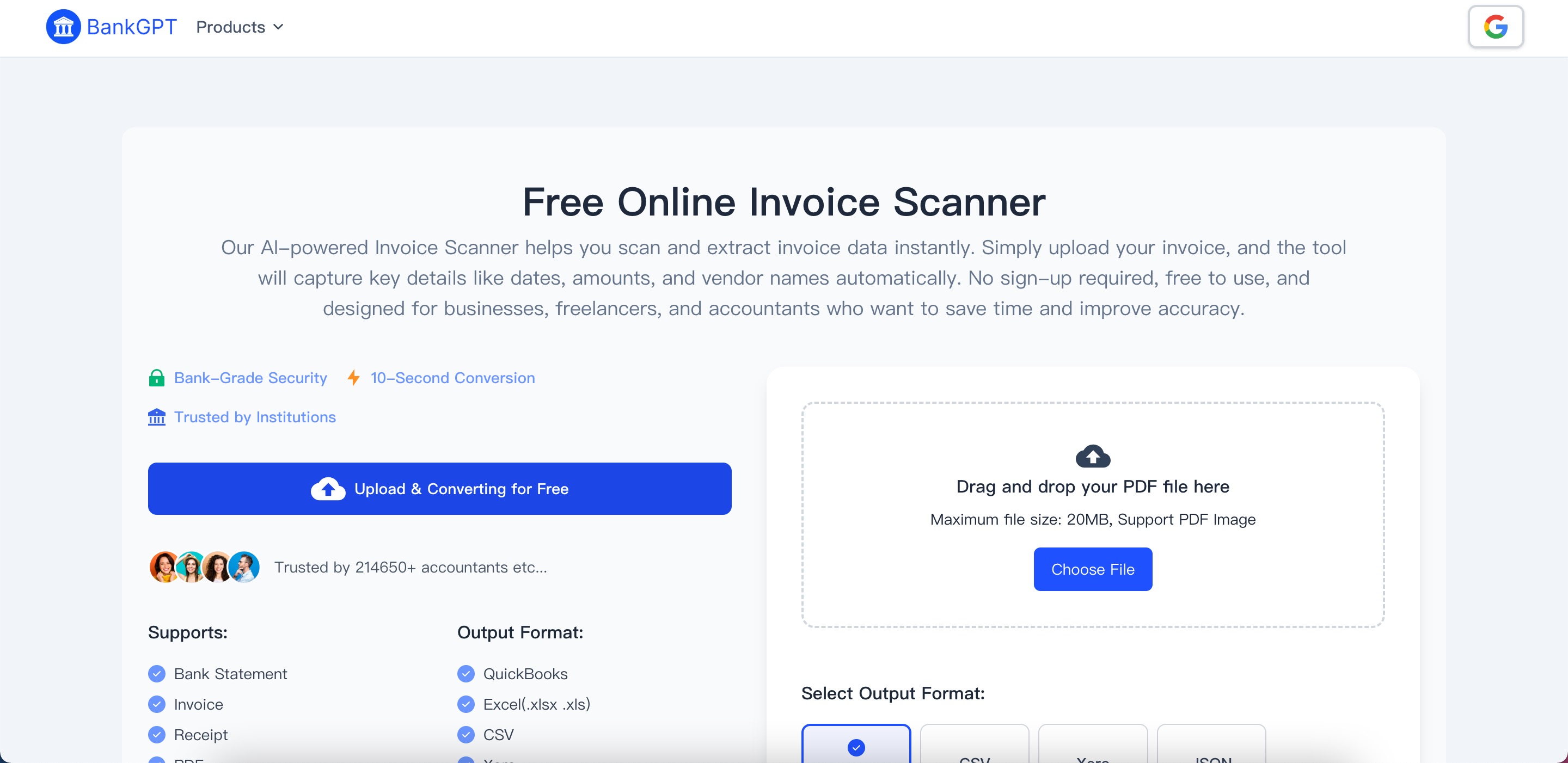

BankGPT is an AI-powered financial intelligence platform designed to help banks, fintech teams, and financial professionals work faster and smarter. With its advanced AI Financial Analyst, Document Parser, Contract Analyzer, and Compliance Checker capabilities, and Invoice Generator, Invoice Scanner, AI Receipt Scanner

, AI Receipt Generator, BankGPT automates complex tasks such as reviewing contracts, analyzing financial data, extracting insights from documents, and ensuring regulatory compliance.

Built for accuracy, speed, and privacy, BankGPT empowers teams to streamline workflows, reduce operational costs, and make better financial decisions with confidence.

Features

1. AI Financial Analyst

- Automatically interprets financial statements, balance sheets, and performance metrics

- Generates AI-driven reports, insights, and trend forecasts

- Helps teams make faster and more data-backed decisions

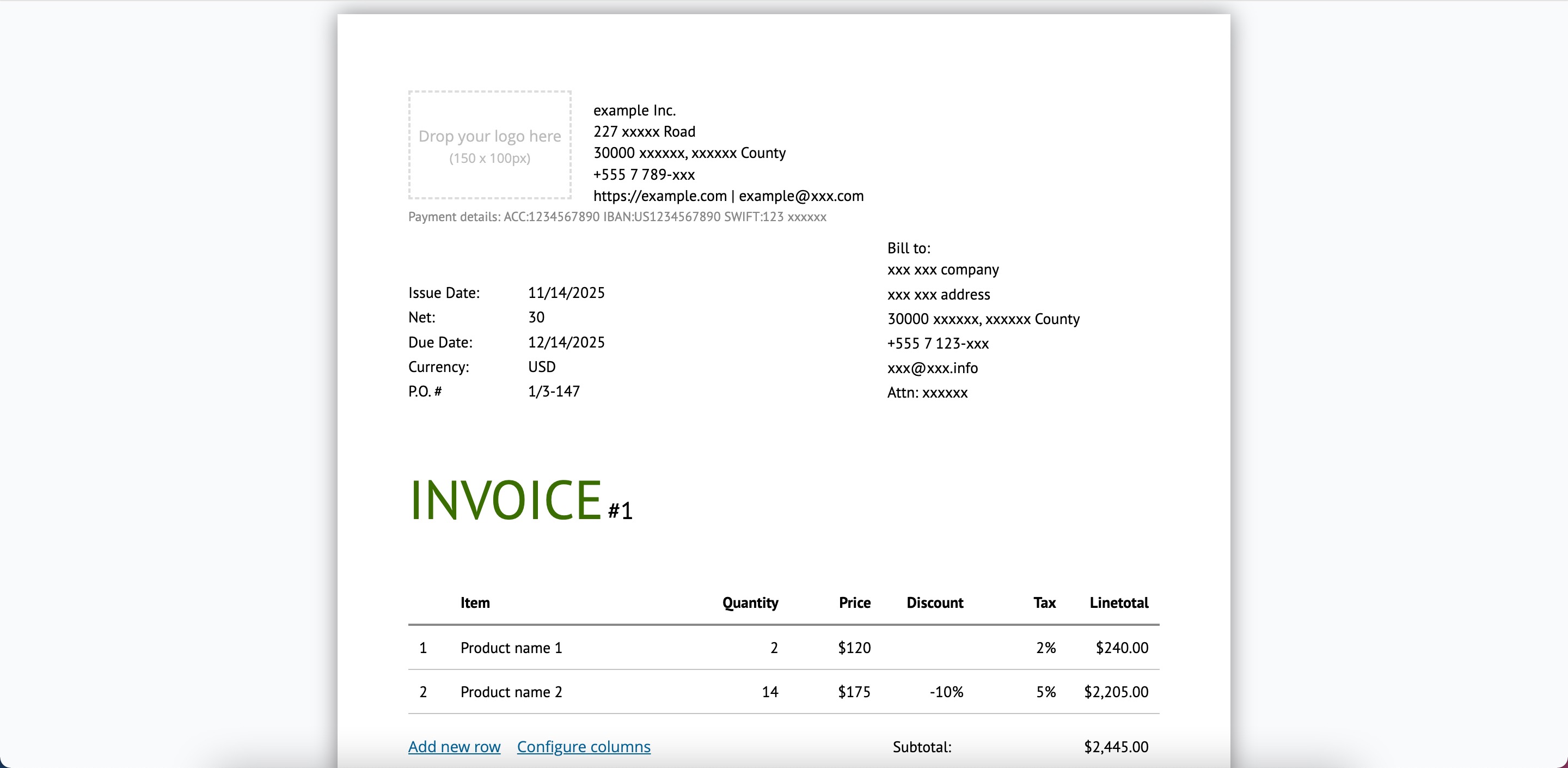

2. Intelligent Document Parser

- Extracts structured data from invoices, contracts, reports, statements, and PDFs

- Cleans, labels, and summarizes large volumes of financial documents

- Supports multi-format and multilingual documents

3. Contract Analyzer

- Highlights key terms, risks, obligations, and renewal dates

- Identifies compliance gaps and unusual clauses

- Compares multiple versions of agreements instantly

4. Compliance Checker

- Reviews documents for AML, KYC, GDPR, SOX, and internal audit standards

- Flags non-compliant content and generates remediation suggestions

- Helps institutions maintain complete regulatory readiness

5. Secure Bank-Grade Infrastructure

- End-to-end encryption for all inputs and outputs

- Enterprise-level privacy controls, no data retained

- Designed for banking, insurance, and financial operations

6. Workflow Automation

- Build automated pipelines for document review, data extraction, reporting, and approvals

- Integrates with internal systems and APIs

- Reduces manual workload across teams

Use Cases

1. Banking Operations

- Automate customer onboarding (KYC) document checks

- Process loan applications and financial statements instantly

- Reduce manual review time for high-volume operations

2. Corporate Finance & Treasury

- Analyze cash flow, liquidity, and risk exposure

- Generate executive summaries and investor-ready insights

- Support scenario modeling and forecasting

3. Legal & Compliance Teams

- Review lengthy contracts in seconds

- Detect risky clauses or compliance issues

- Maintain audit-ready documentation effortlessly

4. Insurance & Fintech

- Parse claim documents and policy contracts

- Improve underwriting and fraud detection accuracy

- Build automated document workflows with BankGPT

5. Investment & Wealth Management

- Analyze portfolio performance and market trends

- Summarize investment reports and company filings

- Support research analysts with instant data extraction

Comments

BankGPT is a powerful step forward for financial teams. The platform combines AI Financial Analysis, Document Parsing, Contract Review, and Compliance Checking into one streamlined workflow. What impresses me most is how fast BankGPT processes complex financial documents and turns them into clean, actionable insights. For banking, fintech, and compliance-heavy teams, BankGPT feels like a true game-changer.

Very neat idea. Having worked in a related space, I know there's a demand for this, especially in the B2B market. One suggestion I'd make though is that using "GPT" in the brand is highly risky, and it'd be better to rebrand now than once you have traction, organic traffic, social mentions etc. Best of luck with your launch!

Premium Products

Sponsors

BuyAwards

View allAwards

View allMakers

Makers

Comments

BankGPT is a powerful step forward for financial teams. The platform combines AI Financial Analysis, Document Parsing, Contract Review, and Compliance Checking into one streamlined workflow. What impresses me most is how fast BankGPT processes complex financial documents and turns them into clean, actionable insights. For banking, fintech, and compliance-heavy teams, BankGPT feels like a true game-changer.

Very neat idea. Having worked in a related space, I know there's a demand for this, especially in the B2B market. One suggestion I'd make though is that using "GPT" in the brand is highly risky, and it'd be better to rebrand now than once you have traction, organic traffic, social mentions etc. Best of luck with your launch!

Premium Products

New to Fazier?

Find your next favorite product or submit your own. Made by @FalakDigital.

Copyright ©2025. All Rights Reserved